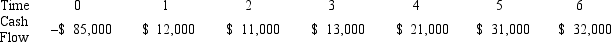

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Expressed

Expressed in a straightforward or obvious manner; explicitly revealed.

Proposition Not-p

A proposition that negates another proposition, symbolically represented as ¬p.

Contraries

Statements, ideas, or actions that are opposed to each other; in logic, two propositions are contraries if they cannot both be true but can both be false.

Negated

Made ineffective or invalidated; in logic, a proposition that denies or contradicts another proposition.

Q1: Daisy D Industries has a cash balance

Q7: PNB Industries has 20 million shares of

Q8: Suppose your firm is considering investing in

Q15: The quantum number that can have only

Q32: The charge of some quarks or anti-quarks

Q32: When a high voltage is applied to

Q33: According to de Broglie,as the momentum of

Q40: For which of the following objects,each with

Q61: Which of the following statements is correct?<br>A)

Q124: Which of the following is NOT a