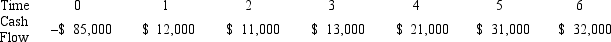

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Performance-Related Pay

A compensation strategy that links employee salary or bonuses to their performance, aiming to motivate and reward employees for achieving specific business goals.

Team-Based Bonuses

Financial rewards provided to group members for achieving or exceeding team performance goals.

Individual Reward Schemes

Reward systems tailored to compensate or motivate individual employees, typically based on their performance or achievements.

Dysfunctional Competition

A market scenario where competition results in negative outcomes, such as reduced innovation or harm to consumers or businesses.

Q6: JackITs has 5 million shares of common

Q18: Magnesium has atomic number 12.In its ground

Q24: What is the difference between a lockbox

Q30: A company is considering two mutually exclusive

Q38: The red light from a HeNe laboratory

Q47: The spin of all quarks is<br>A)0.<br>B)1/2.<br>C)1.<br>D)1/3 or

Q50: You are evaluating a product for your

Q55: Which of the following statements is correct?<br>A)

Q56: Section 179 allows a business,with certain restrictions,to

Q64: FedEx Corp.stock ended the previous year at