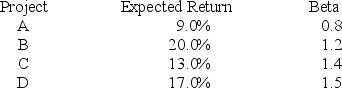

An all-equity firm is considering the projects shown as follows.The T-bill rate is 3 percent and the market risk premium is 6 percent.If the firm uses its current WACC of 12 percent to evaluate these projects,which project(s) ,if any,will be incorrectly rejected?

Definitions:

Drawer

In the context of banking and checks, the individual or entity that writes and signs a check, directing a bank to pay the stated amount.

Drawee

The entity, often a bank, on which a check or draft is drawn and is responsible for paying the amount specified.

Depositary Bank

A financial institution that holds and manages the securities of a depositor, facilitating the exchange of securities and related transactions.

Payor Bank

A bank that is responsible for paying a check or draft on behalf of its client.

Q4: WayCo stock was $75 per share at

Q34: Suppose your firm is considering two mutually

Q46: To correctly project cash flows,we need to

Q48: An estimated WACC computed using some sort

Q55: A fast growing firm recently paid a

Q58: Compute the PI statistic for Project Z

Q74: A production strategy that attempts to improve

Q91: Rose has preferred stock selling for 99

Q94: You have $15,040 to invest.You want to

Q118: At your discount brokerage firm,it costs $8.50