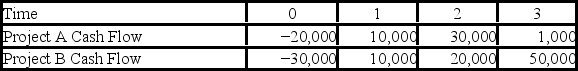

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.  Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Benefit Marketing

A marketing strategy that focuses on highlighting the advantages or benefits that a product or service offers to consumers.

Profit Responsibility

An obligation to manage activities and resources in such a way as to achieve financial profitability for an organization.

ISO 14000 Initiative

A series of environmental management standards developed by the International Organization for Standardization aimed at helping organizations minimize their environmental impact.

Kyoto Protocol

An international treaty that commits state parties to reduce greenhouse gas emissions, based on the premise that global warming exists and human-made CO2 emissions have caused it.

Q3: The ground state configuration for an element

Q5: Which of the following statements is incorrect?<br>A)

Q7: Compute the NPV statistic for Project X

Q27: Which of the following is the IRS

Q34: The stars farther than 20 000 LY

Q37: Safety stock is referred to as the:<br>A)

Q40: A disadvantage of the payback statistic is

Q43: Suppose your firm is considering two mutually

Q91: Rank the following three stocks by their

Q123: Which of these is an entity who