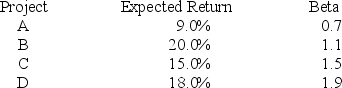

An all-equity firm is considering the projects shown as follows.  The T-bill rate is 4 percent and the market risk premium is 8 percent.If the firm uses its current WACC of 13 percent to evaluate these projects,which project(s) will be incorrectly accepted?

The T-bill rate is 4 percent and the market risk premium is 8 percent.If the firm uses its current WACC of 13 percent to evaluate these projects,which project(s) will be incorrectly accepted?

Definitions:

Worthless Today

Describes assets or investments that have lost all monetary value in the current period.

Significant Liability

Substantial financial obligations or debts that a company or individual has, which can impact financial health.

Credit Cards

Financial tools issued by banks allowing cardholders to borrow funds within a pre-approved limit for purchases or cash advances, typically requiring repayment with interest.

Mortgages

Loans secured by real property, typically used by individuals or businesses to purchase homes or real estate.

Q10: A 2.5 percent TIPS has an original

Q12: Your company is considering the purchase of

Q33: Suppose your firm is considering investing in

Q40: Sharif's portfolio generated returns of 10 percent,9

Q54: Suppose that Tan Lines' common shares sell

Q74: Which of the following is an index

Q90: Which of the following statements is true?<br>A)

Q92: A 4.75 percent coupon bond with 12

Q94: All capital budgeting techniques:<br>A) render the same

Q116: Suppose that a firm's recent earnings per