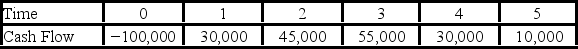

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.  Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Dependent Clause

A group of words that contains a subject and a verb but does not express a complete thought and cannot stand alone as a sentence.

Complex Sentence

A sentence type that contains one independent clause and at least one dependent clause, expressing complicated thoughts with more detail.

Independent Clause

An independent clause is a group of words that contains a subject and a verb and expresses a complete thought, capable of standing alone as a sentence.

Dependent Clause

A group of words with a subject and verb that cannot stand alone as a complete sentence.

Q1: Suppose your firm is considering two mutually

Q7: PNB Industries has 20 million shares of

Q34: Tritium (<sup>3</sup>H)has a half-life of 12.3 years

Q41: In an analysis relating Bohr's theory to

Q51: In the n = 4 shell,how many

Q61: Of the various wavelengths emitted from a

Q86: An important use of x-ray diffraction was:<br>A)the

Q94: A manager believes his firm will earn

Q105: Compute the MIRR statistic for Project J

Q114: Which of these makes this a true