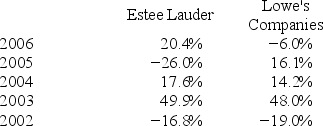

Consider the following annual returns of Estee Lauder and Lowe's Companies:  Compute each stock's average return,standard deviation,and coefficient of variation.

Compute each stock's average return,standard deviation,and coefficient of variation.

Definitions:

Service Distributions

The channels through which services are delivered to customers, involving the physical or digital means by which services are provided.

Probabilistic Demand

A forecasting approach that estimates the likelihood of various levels of demand for products or services based on probability distributions.

Lead Times

The duration between the initiation and completion of a process or project, often used in manufacturing and supply chain management to schedule production or deliveries.

Probability

The measure of the likelihood that an event will occur, expressed as a number between 0 and 1.

Q9: Which of the following are main issuers

Q10: Suppose we observe the following rates: <sub>1</sub>R<sub>1</sub>

Q38: Investor enthusiasm causes an inflated bull market

Q45: If the Japanese stock market bubble peaked

Q63: A particular security's default risk premium is

Q69: GEN has 3 million shares outstanding and

Q72: Which of the following will impact the

Q82: The Wall Street Journal reports that the

Q84: A 3.25 percent coupon municipal bond has

Q103: Suppose your firm is considering investing in