Financial Statements for Quade Company Appear Below Total Dividends Paid During Year 2 Were $210,000,of Which $18,000

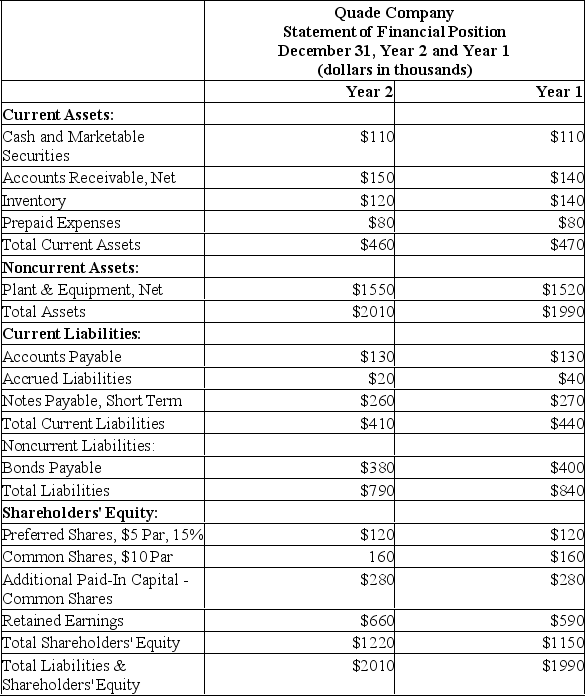

Financial statements for Quade Company appear below:

Total dividends paid during Year 2 were $210,000,of which $18,000 were preferred dividends.The market price of a common share on December 31,Year 2 was $230.

Required:

Calculate the following for Year 2:

a)Earnings per share.

b)Price-earnings ratio.

c)Dividend yield ratio.

d)Return on total assets.

e)Return on common shareholders' equity.

f)Book value per share.

Definitions:

Inadequate Recognition

A situation where individuals or their contributions are not duly acknowledged or appreciated, which can lead to dissatisfaction and demotivation.

Major Stressor

A significant event or situation that causes a substantial amount of stress, potentially leading to health problems or emotional distress.

Cumulative Trauma Disorders

A category of occupational injuries resulting from prolonged repetitive work, which affects muscles, tendons, and nerves.

Repetitive Motion Injuries

Injuries caused by repeated physical movements which strain body parts, often occurring in workplace settings.

Q26: Orantes Company's current ratio at the end

Q36: Last year,DJ's Soda Fountains,Inc.reported an ROE =

Q41: These individuals follow a firm,conduct their own

Q88: Which of the following is associated

Q98: Orange Company's earnings per common share for

Q105: Denny Corporation is considering replacing a technologically

Q118: Assume the company has 50 units left

Q124: Larned Company's earnings per common share for

Q130: Crawler Company's net income last year was

Q178: Not all cash inflows are taxable.