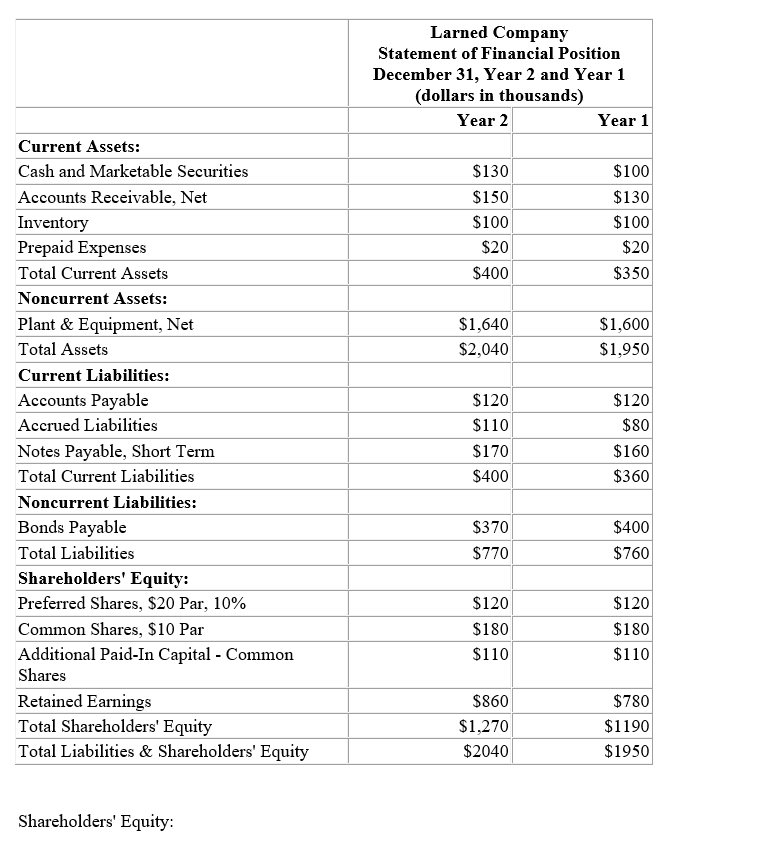

Financial statements for Larned Company appear below:

Shareholders' Equity:

Total dividends during Year 2 were , of which were for preferred shares. The market price of a common share on December 31, Year 2 was .

-Larned Company's dividend yield ratio on December 31,Year 2 was closest to which of the following?

Definitions:

Claim

A formal request or demand for payment or another benefit, based on the terms of an insurance policy or contract.

Trust Fund

A legal entity created to hold assets for the benefit of specific individuals or organizations, managed by a trustee.

Hold-Back

The retention of a part of the contract price by the owner as required under construction lien legislation to ensure payment of subcontractors and suppliers of materials.

Suppliers Of Goods And Services

Entities or individuals that provide the market with products or perform tasks as a business.

Q26: Orantes Company's current ratio at the end

Q27: If an average home in your town

Q32: Capital cost allowance (CCA)deductions shield revenues

Q34: A study has been conducted to determine

Q45: Information concerningthe common shares of Morris

Q45: Oasis Products,Inc.has current liabilities = $10 million,current

Q58: Green Hornet Company is contemplating

Q78: The present value concept considers both

Q97: Why are the net present value and

Q125: We call the process of earning interest