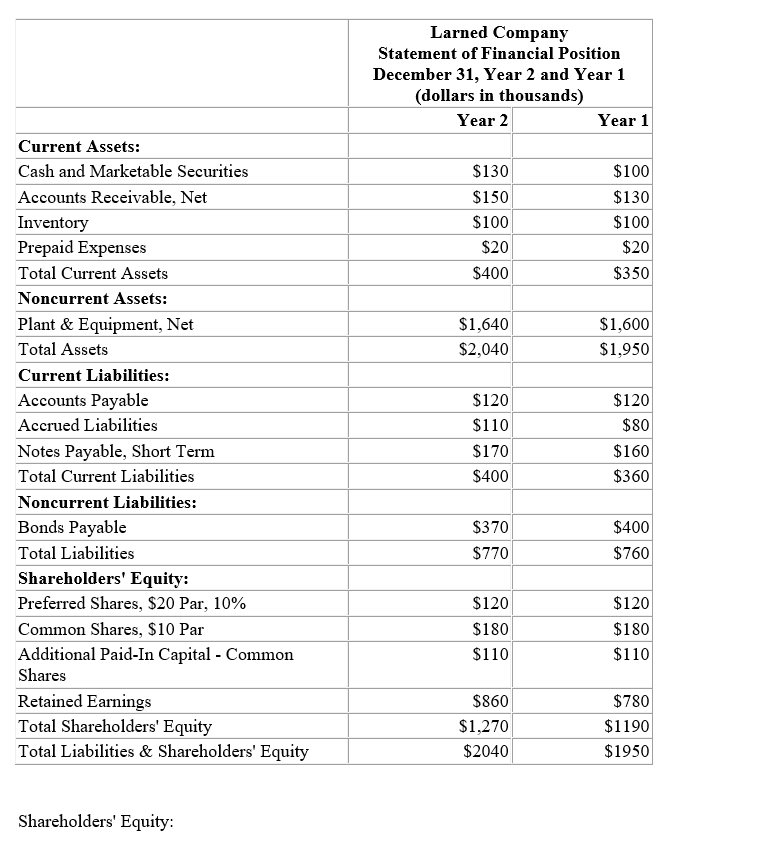

Financial statements for Larned Company appear below:

Shareholders' Equity:

Total dividends during Year 2 were , of which were for preferred shares. The market price of a common share on December 31, Year 2 was .

-Larned Company's return on total assets for Year 2 was closest to which of the following?

Definitions:

Actual Production

The measure of the quantity of goods or services produced by a company during a specific period.

Flexible Budget

A flexible budget adjusts according to the actual levels of activity experienced, allowing for more accurate comparisons of budgeted to actual performance.

Static Budget

A budget that is set for a specific level of activity and does not change or adjust with the actual level of activity achieved.

Fixed Manufacturing Overhead

The set costs involved in producing a product that do not change with the level of production, such as rent, salaries, and utilities.

Q4: Which of the following statements is correct?<br>A)

Q12: Vernon Company has been offered

Q18: The internal rate of return of

Q30: You are considering investing in Totally Tire

Q75: Which of the following is an example

Q78: You are thinking of investing in Ski

Q87: You have been given the following information

Q112: Trina'sTrikes,Inc.reported a debt-to-equity ratio of 2 times

Q124: Projects with shorter payback periods are always

Q181: Which of the following items is