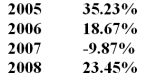

You have the following rates of return for a risky portfolio for several recent years:

-If you invested $1,000 at the beginning of 2005 your investment at the end of 2008 would be worth ___________.

Definitions:

Variable Inputs

Resources used in production that can vary in quantity in the short run, such as labor and raw materials.

Diminishing Returns

A principle stating that as investment in a particular area increases, the rate of profit from that investment, after a certain point, cannot continue to increase if other inputs remain constant.

Fixed Inputs

Resources used in production that cannot be easily increased or decreased in the short term, such as buildings or machinery.

Variable Inputs

Resources or factors of production whose quantity can be changed in the short term to influence output.

Q8: Problems with behavioral finance include:<br>I.the behavioralists tell

Q22: The approximate dollar value of trades on

Q29: Assume that both X and Y are

Q34: In 1997 CSX successfully purchased a significant

Q39: _ is considered to be an emerging

Q55: The center of mass of a uniform,symmetric

Q57: An important assumption underlying the use of

Q67: The Vanguard 500 Index Fund tracks the

Q71: Consider the following $1,000 par value zero-coupon

Q82: According to results by Seyhun _.<br>A) investors