Multiple Choice

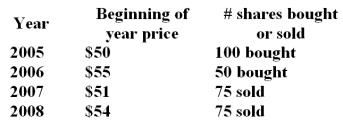

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends

-What is the dollar weighted return over the entire time period?

Definitions:

Related Questions

Q12: The two principal types of REITs are

Q18: Research has identified two systematic factors that

Q20: A flat metal disk has a diameter

Q29: A thin straight wire of uniform density

Q31: Bonds with coupon rates that fall when

Q35: A _ is a value above which

Q36: Standard deviation of portfolio returns is a

Q38: An investment advisor has decided to purchase

Q54: Which one of the following is a

Q61: On a particular day,there were 920 stocks