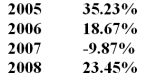

You have the following rates of return for a risky portfolio for several recent years:

-If you invested $1,000 at the beginning of 2005 your investment at the end of 2008 would be worth ___________.

Definitions:

Treasury-Bill Rate

The interest rate yield on U.S. government short-term debt securities known as treasury bills.

Reward-to-Variability Ratio

This ratio, often called the Sharpe ratio, measures the return of an investment relative to its risk, whereby a higher ratio indicates a more desirable outcome.

Risk-Free Asset

An investment perceived to have no risk of financial loss, often exemplified by government bonds.

Expected Return

The anticipated return on an investment based on the probabilities of various outcomes, factoring in both potential gains and losses.

Q9: Under SEC rules,the managers of certain funds

Q40: According to the capital asset pricing model,a

Q43: You can be sure that a bond

Q44: As of 2008,approximately _ of mutual fund

Q54: Which one of the following would be

Q60: If investors are too slow to update

Q61: If you want to measure the performance

Q63: The variance of the return on the

Q71: Investing in two assets with a correlation

Q78: Random price movements indicate _.<br>A) irrational markets<br>B)