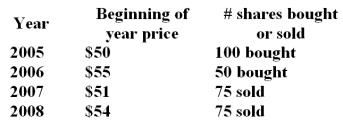

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends

-What is the dollar weighted return over the entire time period?

Definitions:

Nurture

The care and attention given to something or someone to support their growth, development, or well-being.

MBTI

Myers-Briggs Type Indicator, a psychometric tool designed to measure psychological preferences in how people perceive the world and make decisions, based on Carl Jung's theory of personality types.

Promote Diversity

Efforts and practices aimed at encouraging representation and participation of different groups of people, based on race, ethnicity, gender, sexual orientation, age, and other characteristics, within an organization or community.

Machiavellianism

A personality trait characterized by a manipulative, deceitful, and exploitative approach to interpersonal relationships and strategies.

Q3: The average rate of return on U.S.Treasury

Q6: Which of the following is not a

Q7: Which one of the following measure time

Q15: The term excess-return refers to _.<br>A) returns

Q31: During the 1926 to 2008 period the

Q45: June call and put options on King

Q49: A thin rectangular plate of uniform

Q59: The annualized average return on this investment

Q65: A convertible bond has a par value

Q67: Which one of the following statements about