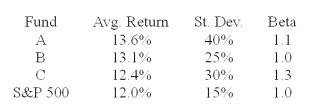

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%.

-You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation.The fund with the highest Sharpe measure of performance is __________.

Definitions:

Cystic Fibrosis

A genetic disorder affecting the lungs and other organs, characterized by thick, sticky mucus that can block airways.

Carbon Monoxide Poisoning

A potentially fatal condition caused by inhaling carbon monoxide gas, leading to symptoms such as headache, dizziness, and nausea, due to reduced oxygen carrying capacity of blood.

Q3: You believe that the spread between the

Q5: On January 1,you sold one April S&P

Q8: The Black-Scholes hedge ratio for a long

Q16: A passive benchmark portfolio is _.<br>I.a portfolio

Q18: You purchase one IBM July 120 call

Q21: You wish to evaluate the three mutual

Q21: The term "hedge" refers to an investment

Q56: What is your annualized return over the

Q57: Which of the following investment strategies would

Q84: Which of the following assets is most