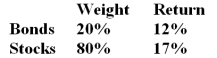

In a particular year, Salmon Arm Mutual Fund earned a return of 16% by making the following investments in asset classes:  The return on a bogey portfolio was 12% calculated as follows:

The return on a bogey portfolio was 12% calculated as follows:

-The total excess return on the managed portfolio was __________.

Definitions:

Myth Of The "fixed Pie"

The false belief that all negotiations or conflicts are zero-sum situations, where one's gain is directly proportional to another's loss, ignoring the potential for mutually beneficial outcomes.

Salary Demand

The amount of money or compensation an employee requests or requires from an employer for their work or services.

Medical Benefits

Health-related advantages or coverage provided by employers or government programs to individuals, typically including services like medical treatments, surgeries, and hospital stays.

Mediation

A form of conflict resolution where a neutral third party aids the disputing sides in reaching a mutually satisfactory agreement.

Q1: The length of time you keep your

Q9: Higher returns of equity hedge funds as

Q11: Advantages of exchange traded options over OTC

Q21: Low interest rates after 2008 and 2009

Q21: According to the put-call parity theorem,the payoffs

Q26: The total excess return on the managed

Q29: If a firm has a free cash

Q65: The comparison universe is _.<br>A) the bogey

Q86: The contribution of security selection within asset

Q95: The government employs monetary and fiscal policy