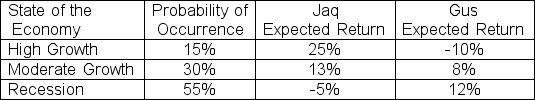

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts,what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

Definitions:

Coenzyme FAD

A redox-active coenzyme associated with various enzymes and involved in several important metabolic reactions, full name flavin adenine dinucleotide.

Phosphorylated

Refers to a molecule that has been modified by the addition of a phosphate group, often altering its function or activity.

Glucose

A simple sugar and a key energy source for cells, it plays a critical role in cellular respiration and energy metabolism.

Vitamin B12

An essential vitamin necessary for the normal functioning of the brain and nervous system, and for the formation of blood.

Q2: Which of the following form is classified

Q5: Assume the following: underlying asset spot $200,storage

Q9: Put-call parity is based on which one

Q32: Suppose you have a total return of

Q34: Which of the following is NOT a

Q37: Amir has obtained a $250,000 mortgage.The mortgage

Q68: Use the following two statements to answer

Q72: The arithmetic average daily return for Dopey

Q103: Use the following two statements to answer

Q104: A pharmaceutical company has discovered a new