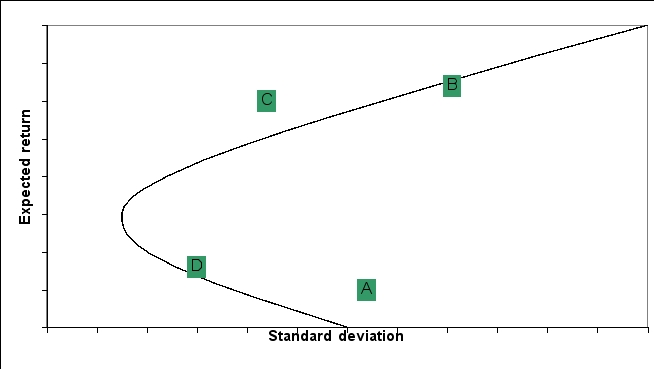

The standard deviation and expected returns for 4 portfolios (A,B,C,and D) are graphed on the following efficient frontier:  Which of the following portfolios are efficient?

Which of the following portfolios are efficient?

Definitions:

Call Option

A financial contract that gives the holder the right, but not the obligation, to buy a stock, bond, commodity, or other assets at a specified price within a specific time period.

Cash Flow Hedge

A cash flow hedge is a hedging strategy used to manage exposure to variability in cash flows associated with a particular risk, typically related to interest rates, commodity prices, or currency exchange rates.

British Pounds

The currency of the United Kingdom, which is one of the world's major currencies used for international trade and investment.

Forward Contract

A tailored agreement between two entities to purchase or sell a specific asset at a predetermined price on a future date.

Q23: Which of the following is NOT relevant

Q27: An investor bought a bond at par

Q28: A corporation's board of directors should first

Q30: Share incentive plans may NOT produce the

Q43: The basic put-call parity can be rearranged

Q47: Marie invested $3 million in 10-year bonds

Q48: Which of the following observations would provide

Q50: Who,of the following,does NOT have a contractual

Q70: Which of the following ratios are "stock

Q82: An investment pays $2,000 every month for