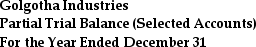

Golgotha Industries provided the following partial-trial balance for the current year.Beginning with the line item Income from Continuing Operations Before Taxes,prepare a statement of comprehensive income for the year ended December 31.Golgotha is subject to a 40% income tax rate.

Definitions:

Variable Costs

Expenses that vary directly with levels of production or sales volume.

Cost Behaviour

The way in which costs change or remain stable in relation to variations in business activity levels, categorized into fixed, variable, and mixed costs.

Total Unit Costs

The complete cost incurred to produce, store, and sell one unit of a product, including direct materials, labor, and overhead.

Direct Product Cost

Costs that can be directly attributed to the production of specific goods or services, including materials and labor.

Q2: Reversing entries change the amounts reported in

Q20: Refer to Craft Construction.Assume that Craft uses

Q22: Johnson Company neglected to accrue interest expense

Q24: Joe Woods is a first year accountant.Why

Q37: Golgotha Industries provided the following partial-trial balance

Q61: Larry Smith,CPA does not know how to

Q76: TNT Inc charges $125 per month for

Q100: Financial statements are prepared after the temporary

Q131: Companies may choose the method used to

Q163: U.S.GAAP identifies _ period-in-time elements.<br>A)four<br>B)five<br>C)six<br>D)seven<br>