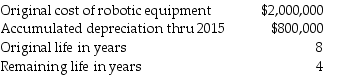

Jenkins,Inc.builds custom machines for manufacturers using robotic equipment.In 2016,the company decided to change from straight-line to double-declining-balance depreciation for its robotic equipment.It changed the life expectancy as follows:

Determine the correct amount of depreciation to expense for 2016.

Determine the correct amount of depreciation to expense for 2016.

A)$250,000

B)$300,000

C)$400,000

D)$600,000

Definitions:

Nutrients

Essential substances obtained from food that are necessary for the body to grow, maintain health, and carry out its functions.

Oxygen

A chemical element with symbol O and atomic number 8, essential for the respiration of most living organisms and for combustion.

Uterine Wall

The muscular wall comprising the outer layer of the uterus, which expands significantly during pregnancy to accommodate a growing fetus.

Embryo

An early stage of development in multicellular organisms following fertilization, before developing into a fetus.

Q2: When a company depreciates a fixed asset

Q17: Which of the following errors will be

Q38: Determine the after-tax cumulative effect in retained

Q59: For securities classified as held to maturity,companies

Q74: Lewis,Inc.began the year with 300,000 shares of

Q77: When assessing realizability of deferred tax assets,management

Q78: Thompson Company sublet a portion of its

Q112: If title does not pass from the

Q119: Initial direct costs are matched with the

Q175: A direct financing lease is classified in