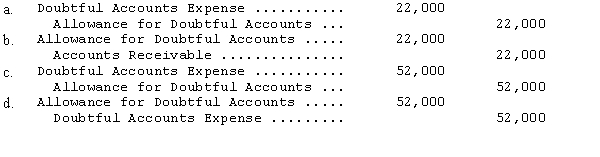

Teller Inc.reported an allowance for doubtful accounts of $30,000 (credit)at December 31,2013,before performing an aging of accounts receivable.As a result of the aging,Teller Inc.determined that an estimated $52,000 of the December 31,2013,accounts receivable would prove uncollectible.The adjusting entry required at December 31,2013,would be

Definitions:

1980

A year marked by significant global events including the eruption of Mount St. Helens and the election of Ronald Reagan as the President of the United States.

Government Ownership

The possession and control over enterprises and assets by the state or government, rather than private individuals or organizations.

Federal Government

The federal government refers to the national government of a country that is responsible for enacting and enforcing laws, collecting taxes, and managing the country’s affairs.

Defense Spending

Government expenditure on military forces and activities, including salaries, benefits, weapons systems, and operations.

Q1: Tussle Company began operations on January 1,2014,and

Q5: You are auditing a company whose management

Q15: What is the cost basis of an

Q36: Which of the following would NOT be

Q43: What is the effect of the collection

Q77: Which of the following equations represent the

Q84: In accounting for a long-term construction contract

Q84: Which one of the following statements is

Q86: Financial information exhibits the characteristic of consistency

Q296: Changes in retained earnings always relate to