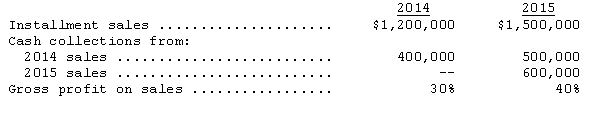

Tussle Company began operations on January 1,2014,and appropriately uses the installment method of accounting.The following data are available for 2014 and 2015:

The realized gross profit for 2015 is

Definitions:

Preferred Dividends

Dividends that are paid out to preferred shareholders before any dividends are distributed to common shareholders, typically at a fixed rate.

Cash Dividend

A distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders in cash.

State Corporation Laws

Regulations established by individual states governing the formation, operation, and dissolution of corporations within their jurisdiction.

Comprehensive Income Items

Components of comprehensive income that represent all changes in equity during a period except those resulting from investments by owners and distributions to owners.

Q3: Which of the following is presented in

Q29: Estimation of uncollectible accounts receivable based on

Q54: Cash equivalents would not include short-term investments

Q54: Pending litigation would generally be considered a(n)<br>A)nonmonetary

Q55: The net amount of a bond liability

Q55: Which of the following is an appropriate

Q69: Osborne Company acquired three machines for $200,000

Q97: Cost of goods sold is equal to<br>A)the

Q106: To compute the price to pay for

Q109: Any gains or losses from the early