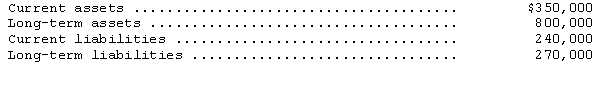

The following totals are taken from the December 31,2015,balance sheet of Mentor Company:

Additional information:

(a)Cash of $38,000 has been placed in a fund for the retirement of long-term debt.The cash and long-term debt have been offset and are not reflected in the financial statements.

(b)Long-term assets include $50,000 in treasury stock.

(c)Cash of $14,000 has been set aside to pay taxes due.The cash and taxes payable have been offset and do not appear in the financial statements.

(d)Advances on salespersons' commissions in the amount of $21,000 have been made.Also,sales commissions payable total $24,000.The net liability of $3,000 is included in Current Liabilities.

After making any necessary changes,what are the totals for Mentor's current assets and current liabilities?

Definitions:

ICD-10-PCS

International Classification of Diseases, Tenth Revision, Procedure Coding System; a system used by healthcare providers to classify and code all diagnoses, symptoms, and procedures.

Provider's Statement

A document or declaration made by a healthcare provider detailing the services offered, treatments provided, or a patient's condition or progress.

Main Term

The primary or central word used to describe a subject or topic in various contexts, such as in indexing or cataloging.

CPT

Current Procedural Terminology, a medical code set used to describe medical, surgical, and diagnostic services and procedures.

Q8: See information regarding Delilah,Inc.above.The following additional information

Q9: The cost of capital is defined as

Q31: The accrual basis of accounting is based

Q59: The Albert Corporation sells merchandise on the

Q79: Kirkland Company's prepaid rent was $40,000 at

Q80: See Teeming Company information above.If Teeming determines

Q84: In accounting for a long-term construction contract

Q208: An increase in a deferred tax liability

Q341: Which of the following is not among

Q384: Worldwide Corp.'s statement of financial position accounts