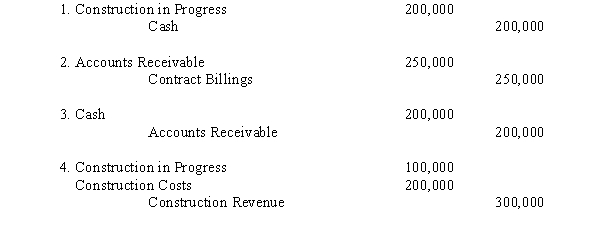

Soborne Construction,Inc.,is constructing a building for another company.Construction on the building began in 2014 and is expected to be complete in 2015.The fixed contract price was $1,500,000.During 2014,the company made the following entries:

Required:

Briefly explain the 2014 entries and why they occurred.Show the calculations and include in your explanations the nature of and the reporting of the Contract Billings account.

Definitions:

Property Tax

Property tax is a levy on property that the owner is required to pay to the government in which the property is situated.

Selling Price

The amount for which a product or service is sold to customers, determining the revenue generated from sales.

Cost Principle

Accounting principle that requires assets, services, and goods to be recorded at their original cost rather than their current market value.

Cost Principle

An accounting principle that states transactions and assets should be recorded at their original purchase cost, factoring out any market value changes.

Q22: When a property dividend is declared and

Q27: A Company showed a large restructuring charge

Q28: On February 1,2013,Forwards Corporation purchased a parcel

Q30: A major controversy in the issuance of

Q38: Using the indirect method,cash flows from operating

Q45: See information regarding Dingo Boot Company above.The

Q51: The average cost method is applicable to

Q53: Panther Corp.reported the following pretax amounts for

Q58: The allowance for doubtful accounts,which appears as

Q90: Which of the following inventory costing methods