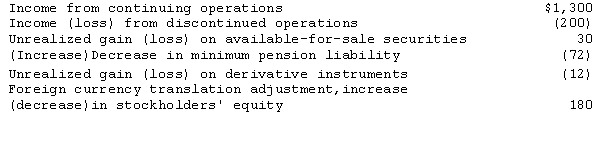

Lexan Company reported the following for the year ended December 31,2014 (all items are net of income taxes) :

Comprehensive income (loss) for the year ended December 31,2014,would be

Definitions:

Cash Sales

Transactions in which payment for goods or services is made at the time of sale, typically in cash form.

Manufacturing Costs

Costs associated with the production of goods, including direct materials, direct labor, and manufacturing overhead.

Insurance Expense

The cost incurred by a business for insurance policies to protect against various risks.

Property Tax

A tax assessed on real estate by the local government, based on the property's value.

Q8: The following data relate to the records

Q10: The Alliance Corporation introduced a new line

Q18: Song Company started construction on a building

Q31: The equity method of accounting should be

Q44: During all of 2014 Rambler Manufacturing Company

Q45: Statement of Financial Accounting Standards No.128,"Earnings Per

Q59: Panther Company does not want to bear

Q61: Feinberg,Inc.,provides a noncontributory defined benefit plan for

Q68: Tundra Co.incurred research and development costs in

Q83: On January 2,2014,Wondrous Co.issued at par $50,000