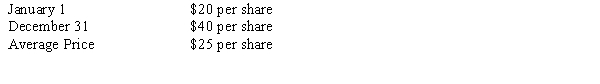

The 2014 net income of Beguile Inc.was $200,000 and 100,000 shares of its common stock were outstanding during the entire year.In addition,there were outstanding options to purchase 10,000 shares of common stock at $10 per share.These options were granted in 2011 and none had been exercised by December 31,2014.Market prices of Beguile's common stock during 2014 were

The amount that should be shown as Beguile's diluted earnings per share for 2014 (rounded to the nearest cent) is

Definitions:

Three-Way Overhead Variance

This is a method used in cost accounting to analyze the differences between actual overhead costs and budgeted overhead costs, broken down into spending, efficiency, and volume variances.

Overhead Spending Variance

The difference between the actual overhead incurred and the overhead costs that were expected or budgeted.

Variable Overhead Efficiency

The measurement of how effectively a company uses its variable overhead resources in the production process.

Product Costing

The process of determining the total cost associated with producing a product, including direct labor, materials, and overhead.

Q5: Earnings per share information should be reported

Q11: A portion of the long-term liability footnote

Q20: Garden Company had pretax accounting income of

Q30: Choose the combination below that best reflects

Q39: The Financial Accounting Standards Board issued Statement

Q48: Information obtained prior to the issuance of

Q53: Under international accounting standards,remote contingent liabilities are<br>A)not

Q59: Alpha had taxable income of $1,500 during

Q59: Using the information above,in the comparative 2013

Q66: Total pension expense recognized over the life