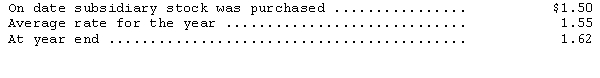

Florence Enterprises,a subsidiary of Verona Company based in New York,reported the following information at the end of its first year of operations (all in euros) : assets--1,320,000; expenses--340,000; liabilities--880,000; capital stock--80,000,revenues--400,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Forecasting Realities

The process of making predictions based on data and recognizing the limitations and uncertainties associated with future events.

Market Demands

The total amount of a product or service that consumers are willing and able to purchase at a given price.

Strength Relationship

The degree to which two variables are related or associated with each other, often used in the context of correlation analysis.

Forecasting Time Horizons

The periods into which future predictions or plans for business, economic, or other activities are divided, ranging from short-term to long-term.

Q6: The amortization of bond discount related to

Q8: Sunrise Technological,Inc.,a U.S.multinational producer of computer hardware,has

Q19: The following information for Amphora Company is

Q26: Warrants exercisable at $15 each to obtain

Q40: The proper analysis of foreign operations by

Q51: Which of the following payroll taxes are

Q52: The following differences between financial and taxable

Q82: The correction of an error in the

Q110: If a company acquires a new machine,the

Q133: Delta Company acquired land and a building