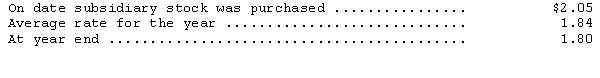

Windsor Enterprises,a subsidiary of Kennedy Company based in New York,reported the following information at the end of its first year of operations (all in British pounds) : assets--338,000; expenses--360,000; liabilities--101,000; capital stock--80;000,revenues--517,000.Relevant exchange rates are as follows:

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Previous Year

The 12-month period immediately before the current year, used as a reference point for comparing data or statistical analysis.

Unemployment

The situation where individuals who are willing and able to work are not currently employed.

Inflation

The magnitude of growth in the overall price points for goods and services, weakening the efficacy of spending power.

Government Spending

The total amount of money expended by a government on various sectors, including infrastructure, education, defense, and social services.

Q3: The accumulated depreciation account represents a growing

Q12: Global Trading Company.converts its foreign subsidiary financial

Q42: Dugger Excavating bought a machine for $24,000

Q59: Which of the following independent transactions would

Q66: Depreciation expense computed under double-declining-balance will decrease

Q83: Repairs made to equipment as part of

Q95: Useful Organizing began operations on January 1,20X3,when

Q99: In 20X3,Little Yard Oil,Inc.,purchased drilling rights for

Q101: Define a "restructuring," give two examples,and explain

Q146: Businesses do not capitalize improvements.