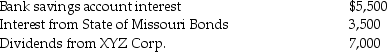

Kevin is a single person who earns $70,000 in salary for 2013 and has other income from a variety of investments,as follows:

Kevin received tax refunds when he filed his 2012 tax returns in April of 2013.His federal refund was $600 and his state refund was $300.Kevin's 2012 federal itemized deductions totaled $13,000.In 2013 his itemized deductions total only $3,700,and the amount of withholding for Federal income taxes is $16,900.

Kevin received tax refunds when he filed his 2012 tax returns in April of 2013.His federal refund was $600 and his state refund was $300.Kevin's 2012 federal itemized deductions totaled $13,000.In 2013 his itemized deductions total only $3,700,and the amount of withholding for Federal income taxes is $16,900.

Compute Kevin's taxable income for 2013.

Definitions:

Relationship Marketing

A strategy designed to foster customer loyalty, interaction, and long-term engagement rather than focusing solely on short-term goals like customer acquisition and individual sales.

Psychographics

Investigating and arranging individuals based on their mental attributes, including aspirations and attitudes, with a primary focus on market research purposes.

Consumer Behaviour

Exploring the actions of individuals, teams, or organizations in choosing, acquiring, deploying, and discarding products, services, experiences, or ideas with the goal of meeting their needs, and the resultant effects of these actions on both the consumer and social fabric.

Products

Items or services offered for sale by a business, ranging from physical goods to digital offerings and services.

Q8: Julia provides more than 50 percent of

Q15: Companies that have a fully installed computer-integrated

Q60: When property is transferred,the gift tax is

Q62: Suri,age 8,is a dependent of her parents

Q64: Kevin is a single person who earns

Q75: Desi Corporation incurs $5,000 in travel,market surveys,and

Q97: Which of the following is not an

Q103: Julia,age 57,purchases an annuity for $33,600.Julia will

Q106: If a loss is disallowed under Section

Q126: In a common law state,jointly owned property