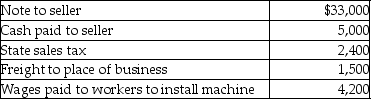

Dennis purchased a machine for use in his business.Mr.Dennis' costs in connection with this purchase were as follows:  What is the amount of Mr.Dennis' basis in the machine?

What is the amount of Mr.Dennis' basis in the machine?

Definitions:

Innovation Process

The sequence of steps involved in the development and implementation of new ideas, products, or services.

Innovation Process

A systematic method that involves the stages of idea generation, development, and implementation of new products, services, or processes.

Identifying Advantages And Disadvantages

The process of evaluating the positive and negative aspects of various options to make informed decisions.

Innovation Process

The series of steps that include the generation, development, and implementation of new ideas or products, leading to market introduction.

Q36: Jade is a single taxpayer in the

Q46: Which of the following is not required

Q58: An individual may not qualify for the

Q62: Emma Grace acquires three machines for $80,000,which

Q66: Brittany,who is an employee,drove her automobile a

Q68: Expenditures incurred in removing structural barriers in

Q70: Ellen,a CPA,prepares a tax return for Frank,a

Q78: In December 2013,Max,a cash basis taxpayer,rents an

Q84: Generally,Section 267 requires that the deduction of

Q115: Mike sold the following shares of stock