Multiple Choice

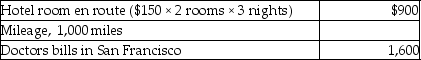

In 2013 Sela traveled from her home in Flagstaff to San Francisco to seek medical care.Because she was unable to travel alone,her mother accompanied her.Total expenses included:  The total medical expenses deductible before the 10% limitation are

The total medical expenses deductible before the 10% limitation are

Definitions:

Related Questions

Q32: All C corporations can elect a tax

Q38: The sale of inventory at a loss

Q38: In September of 2013,Michelle sold shares of

Q60: In January of 2013,Brett purchased a Porsche

Q84: Generally,Section 267 requires that the deduction of

Q86: All of the following statements are true

Q96: Which of the following is not generally

Q104: The amount realized by Matt on the

Q119: Rita,a single employee with AGI of $100,000

Q126: Allison,who is single,incurred $4,000 for unreimbursed employee