MrAnd MrsThibodeaux,who Are Filing a Joint Return,have Adjusted Gross Income of of $75,000.During

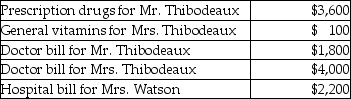

Mr.and Mrs.Thibodeaux,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.  Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

System

A set of principles or procedures according to which something is done; in mathematics, often refers to a set of equations or inequalities.

Elimination

A method used in algebra to solve systems of equations by removing variables to find their values.

Linear Equations

Equations between two variables that produce a straight line when graphed on a Cartesian coordinate system.

Method Of Elimination

A technique for solving systems of equations by adding or subtracting the equations to eliminate one of the variables.

Q2: Nancy reports the following income and loss

Q12: On September 1,of the current year,James,a cash-basis

Q12: Mark purchased 2,000 shares of Darcy Corporation

Q19: Which of the following is true about

Q47: Derrick was in an automobile accident while

Q49: Dana paid $13,000 of investment interest expense

Q52: Discuss tax planning considerations which a taxpayer

Q64: If Houston Printing Co.purchases a new printing

Q106: If a taxpayer disposes of an interest

Q111: Leonard owns a hotel which was damaged