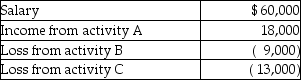

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

Definitions:

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, representing the wear and tear, or expiry of the asset's practical lifespan.

Billed

Billed refers to the issuing of invoices to customers for products sold or services rendered, indicating the amount due for payment.

Balance Sheet

An accounting document showcasing a firm's assets, debts, and equity of shareholders at a precise time.

Last Day

The final day of a given period, often used in the context of contracts, employment, or calendar periods.

Q27: All of the following are requirements for

Q31: During the current year,Martin purchases undeveloped land

Q36: The value of health,accident,and disability insurance premiums

Q60: Mitchell and Debbie,both 55 years old and

Q61: In 2013,Thomas,who has a marginal tax rate

Q65: Stock purchased on December 15,2012,which becomes worthless

Q67: In 1997,Paige paid $200,000 to purchase a

Q76: In a nontaxable exchange,Henri traded in a

Q82: Debbie's Donuts is planning a major expansion

Q109: Wesley completely demolished his personal automobile in