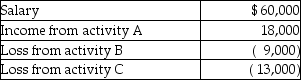

Nancy reports the following income and loss in the current year.  All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

All three activities are passive activities with respect to Nancy.Nancy also has $21,000 of suspended losses attributable to activity C carried over from prior years.During the year,Nancy sells activity C and realizes a $15,000 taxable gain.What is Nancy's AGI as a result of these transactions?

Definitions:

Hypokalemia

A medical condition characterized by lower than normal levels of potassium in the bloodstream.

Prolonged Vomiting

A condition of continuous or recurrent emesis over an extended period, which may lead to dehydration and electrolyte imbalances.

Stomach Contents

The mixture of ingested food, digestive enzymes, and acids found within the stomach.

Osmolarity

A measure of solute concentration per liter of solution, often used in the context of biological fluids.

Q4: If there is a like-kind exchange of

Q20: Intangible drilling and development costs (IDCs)may be

Q28: Under MACRS,tangible personal property used in trade

Q69: When the cost of replacement property is

Q77: Partnerships and S corporations must identify their

Q79: The taxpayer must be occupying the residence

Q88: Justin has AGI of $110,000 before considering

Q90: On July 25 of this year,Raj sold

Q112: If stock sold or exchanged is not

Q128: Donald has retired from his job as