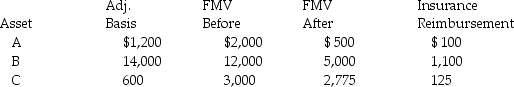

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2013 and the following occurred:

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Indirect Pay

Employee compensation that includes non-monetary benefits such as health insurance, retirement plans, and paid time off, rather than direct cash payments.

Hour Worked

A measurement of labor contributing to the production of goods and services, calculated as the amount of time an employee spends on work activities.

Wage

The fixed regular payment, typically paid on a daily or weekly basis, earned by an employee.

Salary

Regular compensation paid to an employee, usually expressed as an annual sum and paid in monthly or biweekly installments.

Q2: Lindsey Forbes,a detective who is single,operates a

Q3: Capital expenditures add to the value,substantially prolong

Q19: Which of the following individuals is not

Q23: Tia is a 52-year-old an unmarried taxpayer

Q30: Pamela owns land for investment purposes.The land

Q45: Chloe receives a student loan from a

Q59: Self-employed individuals may deduct the full self-employment

Q67: Bob,an employee of Modern Corp.,receives a fringe

Q85: What factors are considered in determining whether

Q94: Emily owns land for investment purposes that