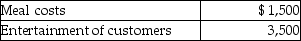

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on the new tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the different dinners.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

High Distinctiveness

Describes situations or attributes that stand out significantly from others, making them more noticeable or memorable.

Bradley Cooper Movie

Refers to any film featuring Bradley Cooper, an American actor known for his roles in various genres of movies.

Mirror Neurons

Neurons that fire both when an individual acts and when the individual observes the same action performed by another, believed to play a role in understanding others' actions, intentions, and emotions.

Fusiform Gyrus

A region of the human brain located in the temporal and occipital lobes, implicated in various functions including face and object recognition.

Q20: Material participation by a taxpayer in a

Q21: Whitney exchanges timberland held as an investment

Q27: Doug pays a county personal property tax

Q34: Vera has a key supplier for her

Q48: All of the following are deductible as

Q48: For purposes of the limitation on qualifying

Q55: Hope sustained a $3,600 casualty loss due

Q76: Melissa acquired oil and gas properties for

Q77: Qualified residence interest consists of both acquisition

Q94: Steven is a representative for a textbook