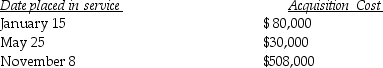

Greta,a calendar-year taxpayer,acquires 5-year tangible personal property in 2013 and places the property in service on the following schedule:

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $900,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2013?

Greta elects to expense the maximum under Section 179,and selects the property placed into service on November 8.Her business 's taxable income before section 179 is $900,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2013?

Definitions:

African

Relating to Africa, its peoples, languages, cultures, or nations, emphasizing the continent's vast diversity and histories.

Chinese

Pertaining to China, its people, culture, or language, with China being an East Asian country known for its vast history and significant global influence.

Chicana

A woman of Mexican descent born or living in the United States, often associated with a sense of cultural and political identity.

Latinas

Women and girls of Latin American origin or descent, often used to specifically refer to those living in the United States.

Q1: Replacing a building with land qualifies as

Q7: Discuss why a taxpayer would want to

Q14: A net Sec.1231 gain is treated as

Q17: Brad and Shelly's daughter is starting her

Q27: A loss on business or investment property

Q27: A taxpayer must use the same accounting

Q30: Max and Alexandra are married and incur

Q50: Pam owns a building used in her

Q70: If no gain is recognized in a

Q82: The sale of inventory results in ordinary