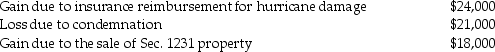

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Cultural Variation

The differences in norms, values, beliefs, and practices among people from different societies or cultural groups.

Organizational Behaviour

The study of how people interact within groups, particularly in a work setting, aiming to understand and improve job performance and satisfaction.

Values

Core beliefs or standards that guide and motivate attitudes and actions, reflecting what is important to an individual or organization.

Equity

The concept of fairness or justice in the manner of treatment or distribution of resources among individuals or groups.

Q1: Elise contributes property having a $60,000 FMV

Q19: Which of the following citations is the

Q27: Section 1245 recapture applies to all the

Q57: Jack purchases land which he plans on

Q65: Tom and Anita are married,file a joint

Q70: If no gain is recognized in a

Q89: Passive activity loss limitations apply to S

Q99: For each of the following independent cases

Q103: Worthy Corporation elected to be taxed as

Q117: A shareholder receives a distribution from a