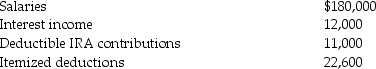

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2014. Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

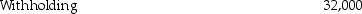

e.What is the amount of their tax due or (refund due)?

Definitions:

Conflict Theory

A perspective in sociology that sees social conflict as the basis of society and social change, emphasizing a materialist view of society, power dynamics, and inequalities.

Dominant Classes

Social groups that hold primary power and influence over others within a given society, often due to wealth, occupation, or education.

Media Effects

The changes or outcomes in audiences' thoughts, feelings, or behaviors resulting from exposure to media content.

Functionalists

Sociologists who analyze society by focusing on how its various institutions and processes work together to maintain stability and order.

Q13: Marisa has a 75% interest in the

Q13: Eva and Lisa each retired this year

Q20: Which of the following taxes is progressive?<br>A)sales

Q21: A business provides $45,000 of group-term life

Q50: The unified transfer tax system,comprised of the

Q51: Hildi and Frank have decided to form

Q55: The exclusion for employee discounts on services

Q65: Minna is a 50% owner of a

Q91: Dexter Corporation reports the following results for

Q94: A deferred tax asset indicates that a