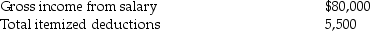

Steve Greene,age 66,is divorced with no dependents. In 2014 Steve had income and expenses as follows:

Compute Steve's taxable income for 2014.Show all calculations.

Compute Steve's taxable income for 2014.Show all calculations.

Definitions:

Merchandise Sold

Pertains to the goods that have been sold to customers by a company during a specific period, often accounted for in the sales revenue section of an income statement.

Accounts Payable

The amount a company owes on short-term debts to its vendors or suppliers.

Investing Activities

Part of the cash flow statement that details cash inflow and outflow related to the purchase and sale of long-term investments and assets.

Financing Activities

Transactions related to changes in the equity and debt of an organization, including issuing shares, paying dividends, and borrowing funds.

Q5: Explain how returns are selected for audit.

Q31: The investment models discussed in the text

Q32: Identify which of the following statements is

Q36: Ellen is a single taxpayer with qualified

Q39: All of the following are executive (administrative)sources

Q45: Kevin is a single person who earns

Q50: Organizational expenses incurred after 2004 are amortized

Q64: Blueboy Inc.contributes inventory to a qualified charity

Q94: A deferred tax asset indicates that a

Q108: Identify which of the following statements is