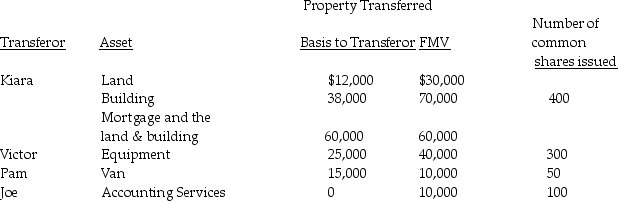

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Required Meetings

Mandatory gatherings designated for discussing agendas, resolving issues, or disseminating information among team members or departments.

Managerial Position

A role or job that involves overseeing and directing the operations and activities within an organization.

Demands

The requirements or needs that must be met by individuals or systems, often within a specific time frame or under certain conditions.

Responsibilities

Obligations or duties that individuals, groups, or organizations are expected to fulfill.

Q1: Nondiscrimination requirements do not apply to working

Q12: The gross estate of a decedent contains

Q32: Mario and Lupita form a corporation in

Q42: On June 1,2014,Ellen turned 65.Ellen has been

Q44: Tax returns from individual and corporate taxpayers

Q64: If a fully-taxable bond yields a BTROR

Q85: The tax law encompasses administrative and judicial

Q86: Rebecca is the beneficiary of a $500,000

Q87: Which of the following requirements must be

Q98: Identify which of the following statements is