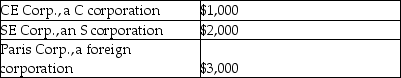

Natasha is a single taxpayer with a 28% marginal tax rate. She received distributions of earnings this year as follows:  How much of the $6,000 distribution will be taxed at the 15% tax rate?

How much of the $6,000 distribution will be taxed at the 15% tax rate?

Definitions:

Carbon Dioxide Retention

A condition in which the lungs are unable to effectively expel carbon dioxide, leading to increased levels in the blood.

Cardiac Output

The volume of blood the heart pumps through the circulatory system in one minute, an important measure of heart function.

Gastric Acid

A highly acidic solution produced by the glands in the stomach, essential for digestion and killing ingested pathogens.

Differential White

A blood test that measures the percentage of each type of white blood cell present in the blood and can reveal conditions such as infections, inflammation, and leukemias.

Q6: Exam Corporation reports taxable income of $800,000

Q40: Describe the components of tax practice.

Q54: Tomika Corporation has current and accumulated earnings

Q65: If a taxpayer's method of accounting does

Q82: Which of the following courts is not

Q88: Identify which of the following statements is

Q89: Julia provides more than 50 percent of

Q102: Demarcus is a 50% partner in the

Q119: Earnings of a minor child are taxed

Q132: Natasha,age 58,purchases an annuity for $40,000.Natasha will