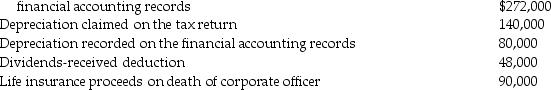

Exam Corporation reports taxable income of $800,000 on its federal income tax return.Given the following information from the corporation's records,determine its book income.

Deduction for federal income taxes per

Definitions:

Social Change

The alteration in the social order of a society, which may include changes in nature, social institutions, social behaviors, or social relations.

Demographic Changes

Alterations in the statistical characteristics of a population over time, including age, race, gender distribution, and other factors affecting population dynamics.

Emergent Norms

Norms that develop spontaneously within a group in response to a new situation or event.

Simple Task

A straightforward or uncomplicated activity or duty.

Q7: All of the following items are deductions

Q11: Premiums paid by an employer for employee

Q31: The following information is reported by Acme

Q41: Jamal,age 52,is a human resources manager for

Q45: Terrell and Michelle are married and living

Q90: Why would a transferor want to avoid

Q94: On May 1 of the current year,Kiara,Victor,Pam,and

Q111: Woods and Tiger Corporations have only one

Q113: Gould Corporation distributes land (a capital asset)worth

Q115: The wherewithal-to-pay concept provides that a tax