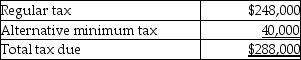

Grant Corporation is not a large corporation for estimated tax purposes and reports on a calendar-year basis.Grant expects the following results:  Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

Definitions:

Imposed Solution

A resolution to a disagreement or dispute that is dictated or enforced by an authority or external party, not by mutual agreement of the involved parties.

Mediation

A process where a neutral third party assists disputing parties in reaching a mutually acceptable agreement.

Surrender Control

The act of willingly giving up authority or power over a situation to another party.

Formal Mediation

A structured process where an impartial third party helps disputing parties reach a resolution by facilitating communication and negotiation.

Q35: Susan owns 150 of the 200 outstanding

Q40: Unlike an individual taxpayer,the corporate taxpayer does

Q42: On June 1,2014,Ellen turned 65.Ellen has been

Q43: One of the requirements that must be

Q46: What type of property should be transferred

Q67: One consequence of a property distribution by

Q78: With some exceptions,amounts withdrawn from a pension

Q82: Daniel plans to invest $20,000 in either

Q83: The Tax Court decides an expenditure is

Q132: Natasha,age 58,purchases an annuity for $40,000.Natasha will