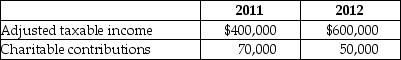

Bermuda Corporation reports the following results in 2009 and 2010:

What is Bermuda's contribution deduction in 2011 and 2012? What is the disposition of any remaining amount?

What is Bermuda's contribution deduction in 2011 and 2012? What is the disposition of any remaining amount?

Definitions:

Income

Payment received, often on a consistent schedule, for employment or from investment profits.

Marginal Ordinary Income Tax Rate

The percentage of tax applied to your income for each tax bracket in which you qualify, increasing progressively as your income surpasses threshold amounts.

Qualified Dividends

Dividend payments received on shares of a corporation, taxed at a lower tax rate than regular income.

Tax Rate

The percentage at which an individual or corporation is taxed.

Q11: Continental Corporation anticipates a 34% tax rate

Q25: Reba,a cash basis accountant,transfers all of the

Q26: Bermuda Corporation reports the following results in

Q52: What is probably the most common reason

Q52: Joe Black,a police officer,was injured in the

Q73: Which one of the following does not

Q79: Frank,age 17,received $4,000 of dividends and $1,500

Q90: Which of the following types of evidence

Q112: Abby owns all 100 shares of Rent

Q133: DeMarcus and Brianna are married and live