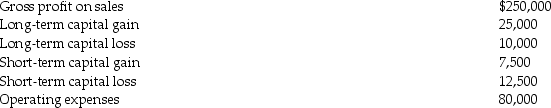

Westwind Corporation reports the following results for the current year:

What are Westwind's taxable income and regular tax liability before credits for the current year?

What are Westwind's taxable income and regular tax liability before credits for the current year?

Definitions:

Collaborative Systems

Information or organizational systems designed to enable and support teamwork and cooperative working among users or participants.

Silent Treatment

A form of non-verbal communication where one refuses to engage in verbal interaction, often as a means of expressing displeasure or punishment.

Conflict Narratives

The stories or accounts people create and share to make sense of and communicate their experience of conflict.

Danger

The possibility of harm or adverse consequences, often requiring caution or preventive measures to ensure safety.

Q1: Money Corporation has the following income and

Q12: Mountaineer,Inc.has the following results: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5381/.jpg" alt="Mountaineer,Inc.has

Q17: Child support is<br>A)deductible by both the payor

Q22: Michelle purchased her home for $150,000,and subsequently

Q29: Eight individuals own Navy Corporation,a C corporation.Three

Q51: Little Corporation uses the accrual method of

Q61: On April 2 of the current year,Jana

Q78: Barker Corporation,a personal service company,has $200,000 of

Q89: Julia provides more than 50 percent of

Q101: Donald has retired from his job as