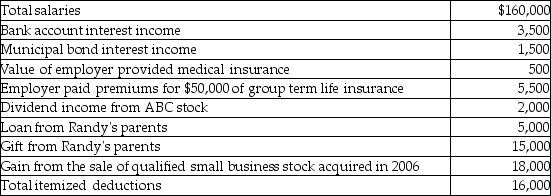

Randy and Sharon are married and have two dependent children.They also fully support Sharon's mother who lives with them and has no income.Their 2014 tax and other related information is as follows:

Compute Randy and Sharon's taxable income.(Show all calculations in good form.)

Compute Randy and Sharon's taxable income.(Show all calculations in good form.)

Definitions:

CVP Income Statement

An income statement format that organizes costs based on whether they are fixed or variable and is used in Cost-Volume-Profit analysis to determine how revenues, costs, and profits are influenced by changes in volume.

Variable Expenses

Costs that change in proportion to the activity of a business such as sales volume or production levels.

CVP Income Statement

A financial report that shows the effects of varying levels of sales and product costs on a company's net income.

Gross Profit

The financial measure representing the difference between sales revenue and the cost of goods sold before deducting administrative and selling expenses.

Q13: John,the sole shareholder of Photo Specialty Corporation

Q41: During 2013,Mark's employer withheld $2,000 from his

Q44: Vanda Corporation sold a truck with an

Q45: Gene purchased land five years ago as

Q79: The assignment of income doctrine does not

Q92: Westwind Corporation reports the following results for

Q96: The transferor's basis for any noncash boot

Q99: Discuss when expenses are deductible under the

Q104: During the current year,Jack personally uses his

Q107: Deferred tax liabilities occur when expenses are