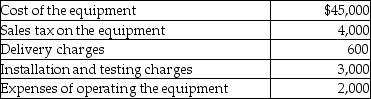

During the current year,Tony purchased new car wash equipment for use in his service station business.Tony's costs in connection with the new equipment this year were as follows:  What is Tony's basis in the car wash equipment?

What is Tony's basis in the car wash equipment?

Definitions:

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, representing the wear and tear or obsolescence of the asset.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was put into use, reducing its book value on the balance sheet.

Asset Turnover

A financial ratio that measures how efficiently a company uses its assets to generate sales, calculated by dividing total revenues by average assets.

Net Sales

The revenue from sales transactions after deducting returns, allowances, and discounts.

Q2: Melanie,a single taxpayer,has AGI of $220,000 which

Q14: How is alternative minimum taxable income computed?

Q17: Randy and Sharon are married and have

Q29: Elisa sued her former employer for discrimination.She

Q37: Points paid to refinance a mortgage on

Q54: Nelda suffered a serious stroke and was

Q61: Rich Company sold equipment this year for

Q65: Blast Corporation manufactures purses and make-up kits.The

Q75: Leigh inherited $65,000 of City of New

Q80: Chloe receives a student loan from a