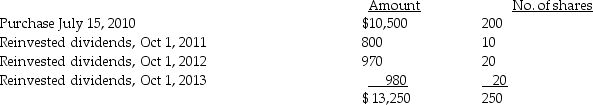

Joy purchased 200 shares of HiLo Mutual Fund on July 15,2009,for $10,500,and has been reinvesting dividends.On December 15,2014,she sells 100 shares.

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

What is the basis for the shares sold assuming (1)FIFO and (2)average cost method?

Definitions:

Daily Demand

The total quantity of a good or service that consumers are willing and able to purchase at a given price on any given day.

Tax

A financial charge imposed by a government on individuals, entities, or transactions to fund public services and projects.

Modernist Painters

Artists who embraced new methodologies and perspectives, rejecting traditional forms and narratives, during the modern art movement spanning the late 19th and early 20th centuries.

Demand Function

An equation that mathematically represents the relationship between the demand for a good and its determinants, such as price, income, and price of related goods.

Q10: Booth Corporation sells a building classified as

Q17: Randy and Sharon are married and have

Q22: All of the following are recognized as

Q36: In determining accumulated taxable income for the

Q48: Van pays the following medical expenses this

Q53: John,an employee of a manufacturing company,suffered a

Q71: Linda had a swimming pool constructed at

Q71: Tim earns a salary of $40,000.This year,Tim's

Q101: Discuss the requirements for meals provided by

Q104: Alan,who is a security officer,is shot while