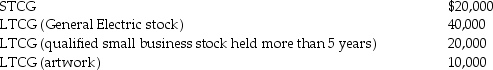

Tina,whose marginal tax rate is 33%,has the following capital gains this year:

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

Definitions:

Common Stock

equity securities that represent ownership in a corporation, providing voting rights and entitling the holder to a share of the company's success through dividends and/or capital appreciation.

Investing Activities

Transactions related to the acquisition or disposal of non-current assets, including securities, property, and equipment.

Net Cash Provided

The amount of cash generated by a company, typically from operating, investing, and financing activities, minus cash outflows.

Par Value

The face value of a stock or bond as designated by the issuer, which has little relation to its market value but is important for accounting purposes.

Q5: In general,if a life insurance policy is

Q19: Identify which of the following statements is

Q21: Dumont Corporation reports the following results in

Q24: All of the following items are excluded

Q28: Identify which of the following statements is

Q28: West Corporation purchases 50 shares (less than

Q36: Mitzi's medical expenses include the following: <img

Q50: Rocky is a party to a tax-free

Q62: When are points paid on a loan

Q67: The Sec.338 deemed sale rules require that